Some producer organizations in the rural South make impressive social and economic progress. Increasingly, these farmers no longer see themselves as poor –trying to survive– but as ambitious rural entrepreneurs. They are improving the livelihoods of their families and have become catalysts for development in their communities.

Gradually, as these organisations grow and expand, they are confronted with a formidable obstacle: access to capital. Smallholder family farmers generally lack own investment capital. And although microfinance has become increasingly widespread, it typically offers small loans to individual farmers.

Generally, long term loans or capital to set up or develop enterprises for collective marketing, processing or trading are not accessible for organized smallholder family farmers. Well-organized banking institutions are often lacking in the South or they consider the risks of the investment too big.

The reasons for this are pretty obvious: from a purely commercial perspective, investing in such businesses involves high transaction costs and is quite risky – also because of all the adversities that can arise in the developing world.

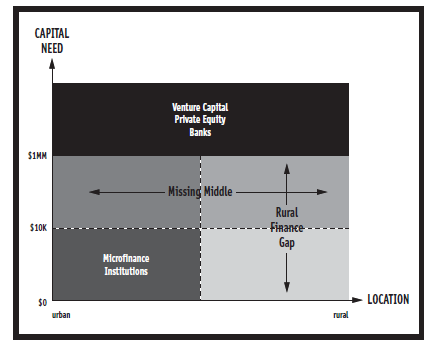

A gap exists therefore between small individual loans on the one hand and industrial loans on the other hand. This gap of investment capital between, roughly spoken, 50,000 and 1 million euro is called the ‘missing middle in agricultural finance’ (source: Oxfam International).

A social impact capital fund

Kampani is designed to help overcome this obstacle for entrepreneurial small-scale farming. It would be set up like a commercial growth capital fund, yet adapted to the particularities of producer organizations in Africa, Asia and Latin America, and focusing on social and development impact instead of financial gain for the investor.

Kampani is innovative in several ways:

- Kampani has raised capital from a consortium of the King Baudouin Foundation, private individuals, the Belgian farmers’ association, social investors and NGOs. It is precisely this combination which offers the greatest guarantee for success. NGOs would be shareholders alongside private investors.

- The know-how, network, and expertise of the private sector would be combined with that of the participating NGOs. It would in the first place be the NGOs and social investors that via their extensive network on the ground would generate the fund’s deal flow. Furthermore, the private investors would bring the discipline of the market, ensure proper and qualitative due diligence, risk management, and business acumen.

- Kampani can provide a subordinated loan, equity (minority shareholder only) or a combination. Kampani will participate actively in the governance of the organisation. The representative of Kampani on the Board of the investee contributes his/her expertise and experience to the investment project. In other words, Kampani’s added value extends beyond the financing only.

- Kampani’s investments will be combined, when appropriate, with continued capacity building, training and other forms of support. Typically, the NGO that first identified the investment opportunity will remain involved as a provider of TA. Since the NGO is a shareholder or mission-aligned partner of Kampani, it has an immediate interest in the success of the investment and consequently of the producer organisation itself. To be clear, Kampani not itself be a provider of technical assistance: neither to the producer organisation itself nor to its business.

- The close cooperation with shareholder Alterfin (a Belgian social investor providing working capital such as harvest financing) and a small number of other like-minded social lenders allows us to jointly address different financing needs at once.

- Kampani takes a long-term (5-10 years) and flexible approach to investments, so that producer organisations can develop their business at a rhythm adapted to themselves and their environments, and together with Kampani, the most adequate moment is determined for divesting the investments to the producer organisation itself or to local financiers.

- Kampani’s impact will be measured through a combination of financial and socio-economic development indicators.

- Kampani pioneers a new instrument to promote economic growth, improve social indicators in the area around the investment opportunity and help safeguard the planet. Kampani’s backers’ hope and ambition is to create a more effective and cost-efficient tool to do so compared to the more traditional aid business model. Kampani’s shareholders accept the high risk and high transaction cost inherent in this business model.

Neither a traditional charity nor a traditional business

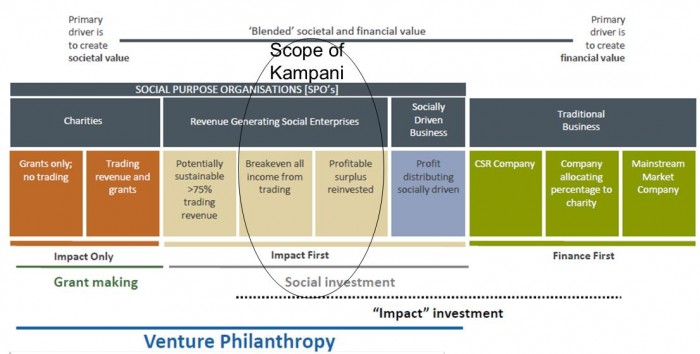

The essence of Kampani is to use capital investment and its methods and procedures to achieve the socio-economic development of small-scale farmers, their families and their communities. For investors in Kampani, this development impact is their primary return on investment. In this respect, as a means of achieving sustainable development, Kampani is to be placed somewhere between charitable grants on the one extreme, and mainstream business on the other, and is part of a whole family of instruments that seek to combine a business approach to development and are known as “ impact investment” – see the diagram below (source: EVPA).

Kampani is, in other words, primarily a development tool. Along with a certain financial return on investment, it aims for a high social return on investment. Kampani’s investment will contribute to higher profitability, more employment, better governance and added value for those businesses while ensuring ecological sustainability.

In the end, we subscribe to the idea that economic growth and investment is a necessary – but not sufficient – requirement to generate lasting improvements in social indicators such as access to healthcare, access to clean water and adequate sanitation, correct housing conditions, reduction in child mortality and morbidity, etc.